Monthly Digest – July 2025

Reporting Period: 2025-07-01 to 2025-07-31

Observation

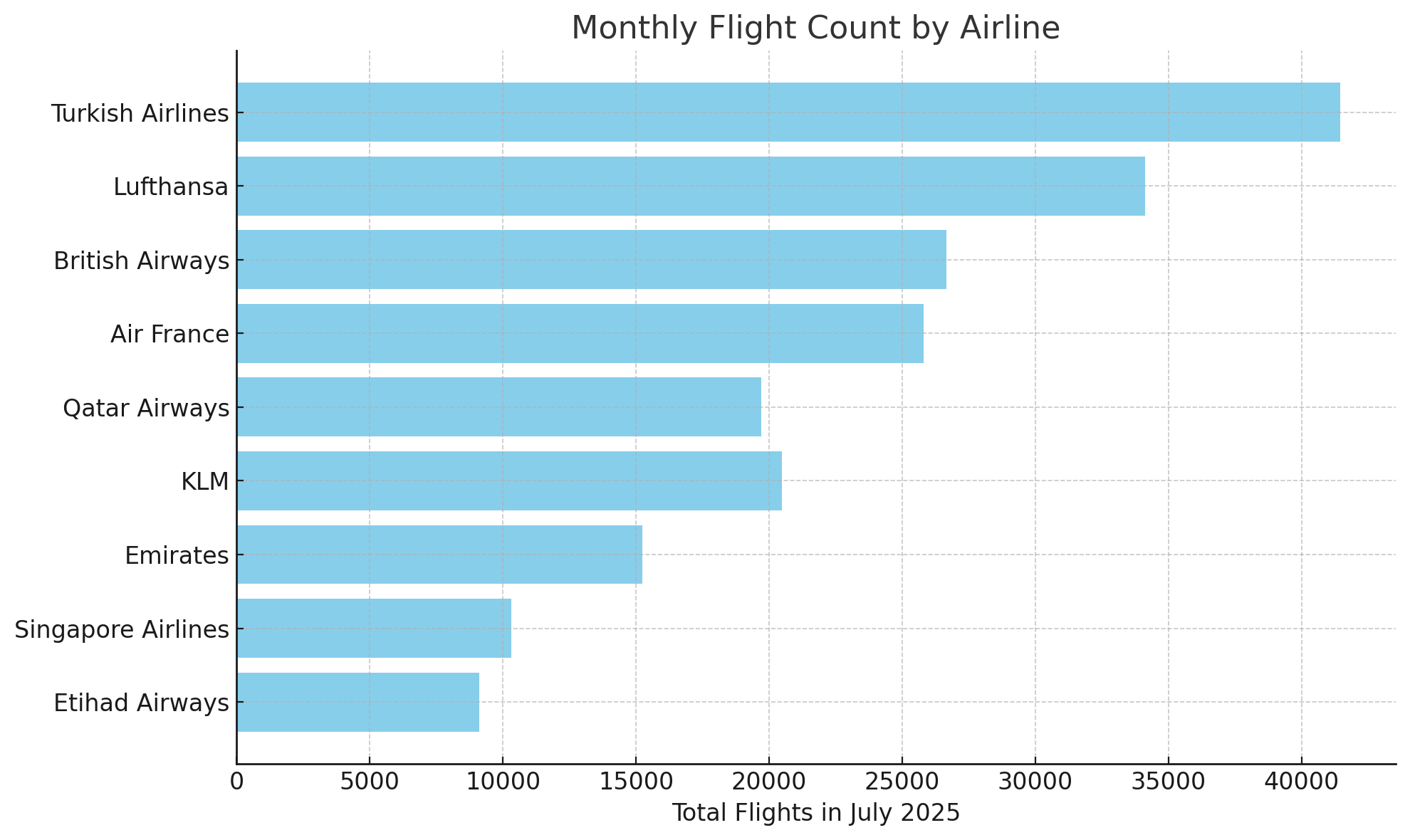

The aviation sector soared into the summer peak with strong momentum. Turkish Airlines extended its dominance, flying over 41,000 flights in July, while Lufthansa, British Airways, and Air France followed with solid performances. Gulf carriers—particularly Qatar Airways and Etihad—posted some of the highest month-over-month growth, signaling a global appetite for long-haul travel.

Headlines

Turkish Airlines Commands the Skies

Turkish Airlines (TK) led all carriers with 41,464 flights in July—an 8.8% increase from June. The Antalya (AYT) – Istanbul (IST) and Ankara (ESB) – IST routes accounted for a major portion of this volume. The Airbus A321 remained the fleet leader, logging 19,738 flights.

Qatar Airways Posts Highest Growth

Qatar Airways (QR) saw a 13.7% jump in total flights, reaching 19,698 operations. London (LHR), Hong Kong (HKG), and key regional cities like Riyadh (RUH) and Jeddah (JED) remained essential destinations. The Boeing 777-300ER (B77W) led their long-haul operations with 8,543 flights.

British Airways Delivers on Transatlantic and Domestic Fronts

With 26,663 flights (+6.4% from June), British Airways (BA) continued strong performance. Edinburgh (EDI), New York (JFK), and Barcelona (BCN) were top destinations, powered by the A320 fleet (15,076 flights).

Air France Maintains Steady Domestic Demand

Air France (AF) registered 25,817 flights in July, a 4.5% increase. Key domestic links such as Paris–Nice (CDG–NCE) and Orly–Toulouse (ORY–TLS) contributed heavily, with the A320 and Bombardier CS300 dominating utilization.

Market Leaders

- Turkish Airlines (TK) – Market share: 20.43%

Exceptional domestic network depth, especially through Istanbul, with notable service to Çukurova (COV), Gaziantep (GZT), and Trabzon (TZX). - Lufthansa (LH) – Market share: 16.82%

Heavy concentration on German corridors like Frankfurt–Munich and Berlin–Frankfurt. - British Airways (BA) – Market share: 13.14%

Balanced strategy across UK domestic and transatlantic connections. - Air France (AF) – Market share: 12.72%

Focused on efficiency across high-frequency domestic links. - Qatar Airways (QR) – Market share: 9.71%

Long-haul heavyweight with extensive presence across Europe, Asia, and the Gulf.

Other Notable Airlines

- KLM (KL): 20,488 flights (+9.7%)

Dominated Amsterdam-based short-haul routes like AMS–LHR and AMS–GVA. Most flown aircraft: B738. - Emirates (EK): 15,241 flights (+8.2%)

DXB–LHR, DXB–BKK, and DXB–BOM topped their route chart. B77W usage exceeded 20,000 flights. - Singapore Airlines (SQ): 10,313 flights (+4.7%)

Strong ASEAN presence, especially on CGK–SIN and KUL–SIN. A359 led operations with 9,449 flights. - Etihad Airways (EY): 9,126 flights (+12.2%)

Significant presence on AUH–RUH, AUH–JED, and AUH–LHR. Fleet leader: B787-9.

| Airline | Top Aircraft | Flights |

|---|---|---|

| Turkish Airlines | A321 | 19,738 |

| Qatar Airways | B77W | 8,543 |

| British Airways | A320 | 15,076 |

| Air France | A320 | 10,143 |

| KLM | B738 | 9,583 |

| Emirates | B77W | 20,148 |

Top Non-Hub Routes

- Turkish Airlines:

- Çukurova (COV) – Istanbul (IST): 1,193 flights

- Trabzon (TZX) – IST: 1,117

- Moscow Vnukovo (VKO) – IST: 1,013

- Qatar Airways:

- Bangkok (BKK) – Doha (DOH): 635

- Riyadh (RUH) – DOH: 624

- Dubai (DXB) – DOH: 581

- British Airways:

- JFK–LHR: 953

- BCN–LHR: 896

- Nice (NCE) – LHR: 841

- KLM:

- Amsterdam (AMS) – Geneva (GVA): 699

- AMS – Oslo (OSL): 698

- AMS – Copenhagen (CPH): 695

Closing Remarks

July 2025 highlighted the aviation industry’s resilience and growth. Airlines across all regions benefited from peak summer travel demand, with Turkish Airlines extending its global lead and Qatar Airways delivering the sharpest growth. Looking ahead, August may bring initial signs of post-summer recalibration, but July’s figures reflect a healthy and competitive aviation landscape.